In the fast-paced world of trading, simulated environments have emerged as powerful tools for aspiring investors. They offer a low-risk playground to refine strategies, hone skills, and familiarize oneself with the tumultuous market dynamics.

Yet, amid the thrill of virtual victories, a subtle danger lurks beneath the surface—overconfidence. As traders bask in the glow of their simulated successes, they may cultivate an inflated sense of their abilities, which can prove perilous when faced with real market challenges.

This article seeks to unveil the nuances of how simulated trading can distort self-perception, leading to misguided decisions. Moreover, we’ll explore effective strategies to ground your trading mindset, ensuring that the lessons learned in the digital realm translate effectively into reality.

So, buckle up as we navigate the intricate interplay between psychological pitfalls and practical trading wisdom.

The Rise of Simulated Trading in Investment Strategy

In recent years, simulated trading has surged in popularity among both novice and seasoned investors, revolutionizing the way individuals approach the complexities of the markets. This digital realm offers a no-risk environment where traders can experiment with strategies, explore volatile assets, and witness the immediate outcomes of their decisions without the sting of financial loss.

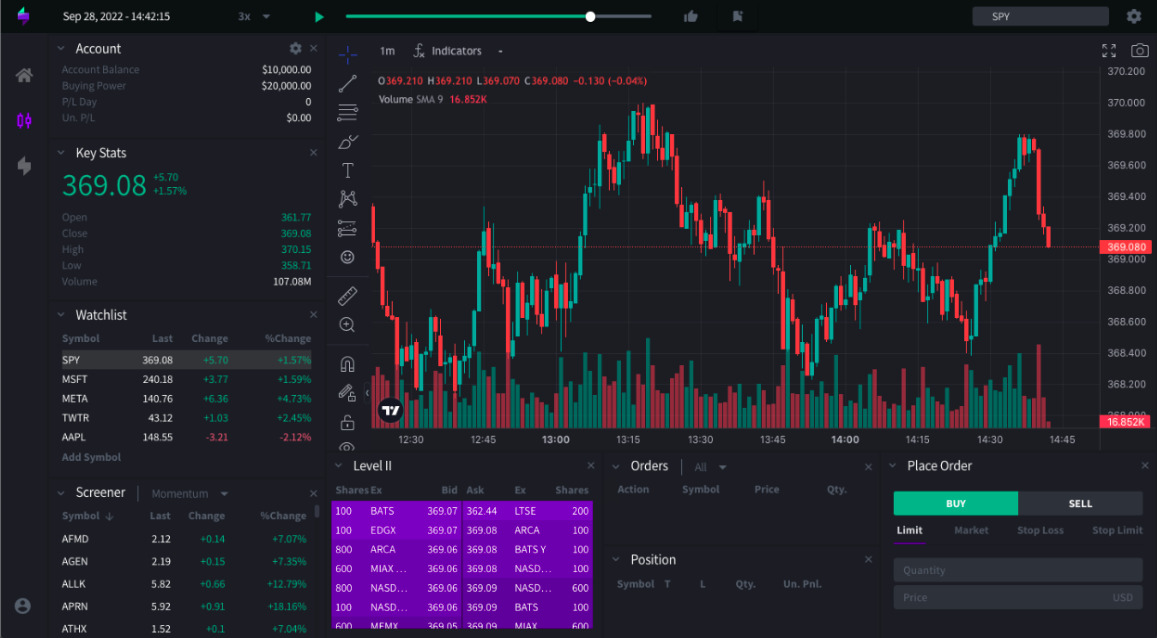

Tools like the free bar replay chart further enhance this experience, allowing traders to replay historical market data, analyze past price movements, and fine-tune their strategies in a risk-free setting. Yet, beneath this enticing facade lies a critical pitfall: the very success that simulation breeds can engender a false sense of confidence.

As participants bask in the glow of theoretical triumphs, the line between skill and serendipity begins to blur, leading to risky behavior when they transition to real-world trading. Thus, the rise of simulated trading, bolstered by features like the free bar replay chart, is both a promising advancement in investment education and a cautionary tale about the psychological traps that may ensnare even the most astute among us.

The Psychology of Overconfidence: Why It Matters

Overconfidence, a trait as alluring as it is perilous, often creeps into the minds of traders, insidiously inflating their self-assessment of skill and knowledge. This cognitive bias can lead to an inflated sense of control over market movements, prompting individuals to take risks that far exceed their actual experience and understanding.

With simulated trading, the feedback loop can amplify this effect; success feels tangible, real even, and in the digital realm, its easy to forget that simulated gains do not equate to real-world profits. As traders bask in the glow of their virtual victories, the danger lies in an unyielding belief that they can replicate these outcomes in the unpredictable arena of actual trading.

The implications are profound: overconfidence may blind traders to the importance of risk management, lead to reckless decisions, and ultimately culminate in significant financial losses. Recognizing the psychological underpinnings of overconfidence is crucial; it enables traders to strike a more realistic balance between confidence in their abilities and humility in their approach.

How Simulated Trading Fosters Overconfidence

Simulated trading, with its exhilarating highs and minimal risks, can create a false sense of prowess among aspiring investors. As traders engage in this risk-free environment, they often experience wins that can inflate their confidence, breeding an illusion of expertise that isnt necessarily grounded in real-world dynamics.

The intuitive nature of virtual platforms — with their instant feedback loops and gamified elements — tends to overlook the crucial element of emotional resilience required in actual trading scenarios. This unchecked overconfidence can lead participants to underestimate market complexities and overcommit their resources, ultimately setting them up for potential pitfalls when they transition to the unpredictable terrain of live trading.

Its this seductive blend of success and ease that can distort judgment, luring even the most cautious of players into a false bravado that may leave them starkly unprepared for the real stakes ahead.

Conclusion

In conclusion, while simulated trading can provide invaluable practice and help traders develop their skills, it can also lead to an unwarranted sense of confidence that distorts their perception of reality. The ease of executing trades in a risk-free environment may create a false sense of mastery, which can result in significant miscalculations when moving to real markets.

To counteract this tendency, traders should actively engage in self-reflection and seek tools that promote a more grounded perspective, such as utilizing a free bar replay chart. This resource allows traders to review and analyze their decision-making processes in real-time, fostering a deeper understanding of market dynamics and reinforcing the need for disciplined, informed trading strategies.

By recognizing the potential pitfalls of overconfidence and implementing corrective measures, traders can better navigate the complexities of the financial world and enhance their overall performance.